Is it possible to navigate the complexities of legal processes and financial aid programs with clarity? Understanding warrant lists, PPP loans, and government oversight is crucial in today's environment, a landscape rife with both opportunities and potential pitfalls.

The landscape of legal and financial information can often seem labyrinthine, a tangled web of regulations, programs, and investigations. From municipal warrant lists to federal loan programs, the information flow is constant, requiring vigilance and a commitment to accurate knowledge. This article seeks to illuminate some key areas, helping readers dissect complex concepts and navigate critical information with a discerning eye. The emphasis here will be on the practical, presenting information in a way that demystifies bureaucratic processes and allows for informed decision-making. We will delve into the mechanics of warrant information, the intricacies of the Paycheck Protection Program (PPP), and the methods used to trace financial transactions in order to paint a clearer picture of these interconnected areas.

Let's delve into the details by creating a mock table using the general information provided for the topic related to the PPP Loan program. This table is designed to be easily integrated into a WordPress environment. It is important to note that the following table is for illustrative purposes only and does not contain any sensitive personal or financial data.

| Category | Details |

|---|---|

| Program Name | Paycheck Protection Program (PPP) |

| Purpose | To provide financial assistance to small businesses and non-profit organizations during the COVID-19 pandemic. |

| Administering Agency | Small Business Administration (SBA) |

| Loan Type | Low-interest loans |

| Loan Forgiveness | Loans could be forgiven if used for eligible expenses (payroll, rent, utilities) within a specified period. |

| Search Tools | Publicly available databases, such as those from ProPublica and government agencies, allowed users to search for approved loans. |

| Oversight | Multiple organizations, including the Department of Justice (DOJ), conducted investigations into potential fraud. |

| Fraud Investigations | DOJ actively pursued businesses suspected of PPP fraud. |

| Warrant Lists | Information related to investigations and warrants may be available through legal channels. |

| Relevant Websites | Small Business Administration (SBA),ProPublica's PPP Loan Tracker (for informational purposes) |

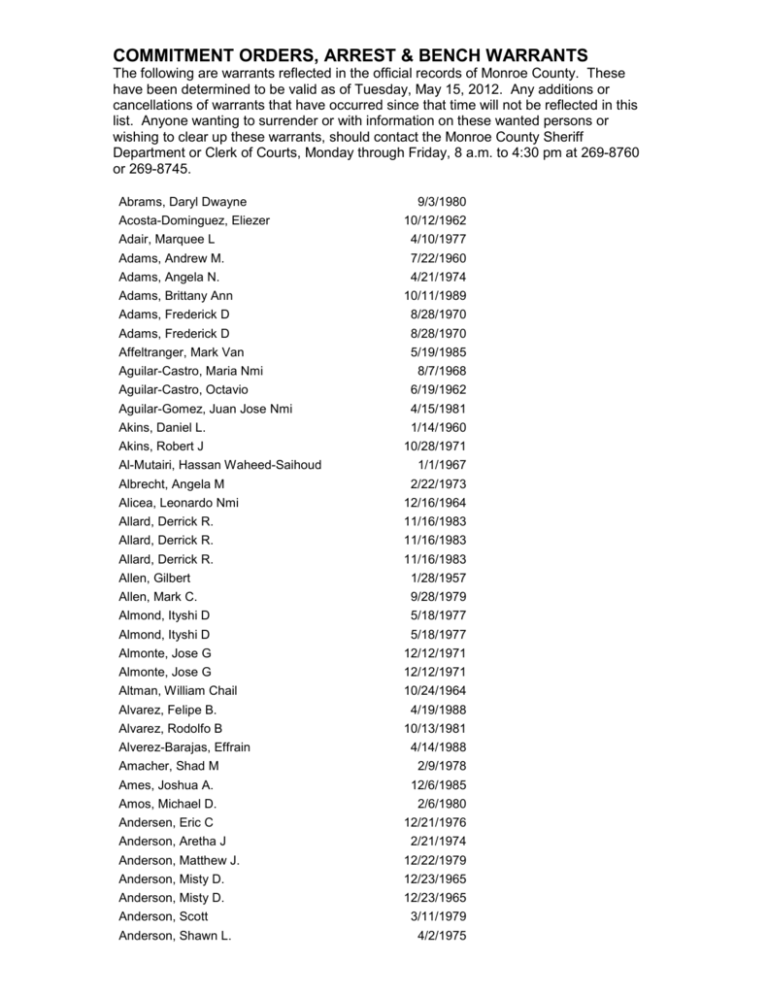

In the realm of law enforcement, understanding warrants is fundamental. The Austin Police Department, like many others, maintains a warrant list, providing a public record of individuals for whom arrest warrants have been issued. The official website for the Austin Police Department has been updated to provide a new link for the warrant list. The old link no longer functions.

Similar to Austin, other jurisdictions, such as Henderson, Nevada, also provide warrant information. The Marshal Service, in Henderson, is charged with serving warrants and providing security within the Justice Facility. The existence of these lists underscores the importance of understanding one's legal standing and the potential ramifications of outstanding warrants. It emphasizes the importance of addressing legal issues promptly and seeking legal counsel when necessary.

The Paycheck Protection Program (PPP) presented a significant opportunity for small businesses to secure financial relief during the economic downturn caused by the COVID-19 pandemic. The federal government injected hundreds of billions of dollars into the economy through low-interest loans. The Small Business Administration (SBA) oversaw the program, and numerous lenders participated. This financial injection was intended to help businesses maintain payroll, cover rent, and meet other essential expenses during a time of significant uncertainty.

However, the scale of the program, and the speed with which it was implemented, also created opportunities for fraud. The Department of Justice (DOJ) aggressively pursued businesses suspected of misusing PPP funds. This has resulted in an increase in investigations and, in some cases, arrests. It is important to be aware of these legal actions and to understand the potential risks associated with non-compliance.

ProPublica provides an invaluable tool for researching PPP loans. Their website contains a comprehensive database of loans approved by lenders and disclosed by the Small Business Administration. This resource allows users to search for specific borrowers and understand the scope of the program within their communities. The FAQ section of the ProPublica project is particularly useful for understanding the intricacies of the program and how to interpret the data.

Numerous small businesses applied for and received loans under the PPP. Now, with investigations ongoing, some of these businesses are encountering legal challenges. This is a crucial reminder that securing a loan comes with responsibilities. It also highlights the necessity of due diligence and meticulous record-keeping to demonstrate compliance with the program's guidelines. Proper use of PPP funds, including maintaining comprehensive records, is crucial to avoid any legal consequences. Consulting with legal and financial professionals is advisable for anyone who has received a PPP loan and is unsure about compliance requirements.

The Scott County, Iowa, also provides a warrant list, with a clear disclaimer. The list is an indication of an accusation, and all persons listed are presumed innocent until proven guilty. This principle of innocent until proven guilty is a cornerstone of the American legal system. It's crucial to note that a warrant merely represents an accusation of a criminal charge. It does not, in itself, establish guilt. This presumption underscores the necessity of a fair legal process. It also emphasizes the importance of respecting the rights of individuals who are subject to warrants.

The situation highlights the vital need for accuracy, proper reporting and record keeping. The government’s provision of financial support, the role of financial institutions in dispensing those funds, and the public's right to information all require clarity. Moreover, it underlines the importance of staying informed about evolving legal and financial landscapes. It serves as a reminder of the need for meticulous record-keeping. It also emphasizes the importance of adhering to regulations. Further, it shows the significance of maintaining transparency in all financial matters.

The information provided by the SBA, ProPublica, and other publicly available sources constitutes valuable resources for both businesses and the public. Being able to search for a borrower, or checking how many people received loans in a given state can be beneficial for people. This enables people to navigate the complexities of financial assistance programs with more confidence.

In conclusion, the interplay of warrant information, the PPP, and related oversight mechanisms illustrates the complex nature of legal and financial accountability. Whether it's understanding the implications of a warrant, navigating the requirements of a loan program, or conducting due diligence, a commitment to accuracy and transparency is paramount. The availability of public records, search tools, and legal resources empower individuals and businesses to make informed decisions and protect their interests. This ongoing landscape requires a proactive approach to legal and financial matters. It demands constant vigilance, careful adherence to regulations, and a commitment to ethical practices.